Understanding Gold Correlations with Other Assets

Since we all know that gold has a very important position in the economy of the world, its value is based on a complex interaction of many economic and industrial factors. By understanding how gold is correlated with other assets, we can better understand the possible benefits of including gold assets in your investment portfolio, like Gold IRAs.

So let’s take a look at various correlations of gold with other asset classes and economic indicators, such as currencies, interest rates, inflation, stock markets, other commodities and economic indicators.

Gold and Currencies

Some of the strongest correlations are between gold and large currencies, particularly the U.S. dollar.

Historically, gold has an inverse relationship with the U.S. dollar. When the dollar weakens, gold prices tend to rise, and vice versa. This is because gold is priced in dollars; a weaker dollar makes gold cheaper for holders of other currencies, thereby increasing demand for gold. Conversely, a stronger dollar makes gold more expensive for international buyers, reducing its demand.

For example in times of dollar deprecation, such as after the 2008 financial crisis, the prices of gold increased as individuals sought a solid store of value. Once again when the dollar is appreciating, typically due to higher interest rates or a growth in the economy in the U.S., gold prices also decline.

Gold and Interest Rates

Interest rates, which are set by central banks, are another crucial factor influencing gold prices. As a general rule, interest rates have an inverse relationship with gold prices. A rise in interest rates means a rise in the opportunity cost of holding zero-yielding assets like gold. This urges investors to shift to other assets that yield higher returns, such as savings accounts or bonds. Hence, gold prices fall as interest rates rise.

Alternatively, when it is a time of low interest rates, the opportunity cost of holding gold decreases. This was the case during the financial crisis and the period in between when economic instability saw central banks like the Federal Reserve lowering interest rates to stimulate growth. At such times, gold prices tend to rise as investors seek refuge and return in a low-return environment.

Gold and Inflation

Historically, gold has been viewed as an inflation hedge, and the two thus should have a negative correlation. When inflation is higher, fiat money purchasing power is lower, and investors turn to gold, which is a wealth-conserving asset. This kind of correlation is a statement about the role of gold as a store of value.

For instance, during the 1970s America was experiencing high inflation and the price of gold went up from roughly $35 an ounce at the start of the decade to over $600 towards its end. More recently inflationary concerns during economic stimulus and quantitative easing have also sent gold prices up.

Gold and Stock Markets

The interaction of gold with stock markets is intricate. Predominantly, gold is inversely correlated with stock markets. During economic stability and bull stock markets, gold prices decline since investors tend towards risk assets with greater returns (although not for the current bull market).

Conversely, in times of stock market falls or increased volatility, gold prices rally as investors flee to gold to protect their money.

As an example, a href=”https://www.goldmansachs.com/our-firm/history/moments/2000-dot-com-bubble”>in the dot-com bubble burst in early 2000s and the 2008 financial crisis, the stock markets reached bottom while gold prices increased. This so-called flight to safety is one strong reason for why gold is seen as a safe haven asset.

Gold and Other Commodities

Gold’s correlation with the rest of commodities, including metals, precious metals and oil is not stable and can jump around wildly.

Gold and silver usually exhibit high correlation since both are precious commodities and investing tools employed as a hedge against inflation. Nevertheless, gold has a stronger safe-haven attribute than silver, and this leads to instances where their correlation falls. Nevertheless, in the long run, gold and silver have a tendency to be correlated at 80% and beyond, just like gold and platinum.

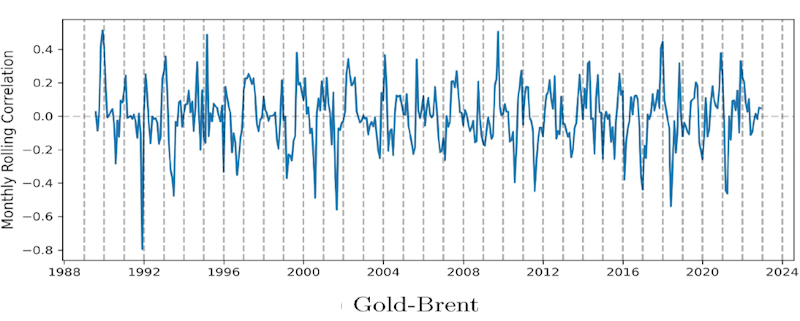

Oil and gold, both also referred to as yellow metal and black gold respectively, do not have a very simple relationship. Their correlation has been varied depending on economics periods in the past. From 1973 to March 2022, for example, two-year correlation between gold price and oil had immense volatility.

Despite being in the commodity category, gold and oil have entirely different fundamentals. The following are some of the key points:

- Oil is severely affected by energy crises

- Gold is likely to be applied as a safe haven during times of economic instability

- Supply and demand dynamics of these two assets vary

Under crisis periods, gold and oil can move in divergent ways. For example, while equity markets were falling between January 1987 and June 2021, oil behaved as a risk asset, while gold tended to diverge from equities. This means that while there are some similarities, the differences between these two commodities are more in count.

In short, though gold and oil have much in common, the manner in which they fluctuate in the markets is drastically different, something that needs to be understood by investors.

Stagflation, i.e. economic recession or stagnation in an inflationary scenario, is the ideal storm for the price of gold to rise. However, this connection does not exist at all times because the price of oil responds to the supply and demand dynamics of the energy market as well.

Gold and Geopolitical Events

Geopolitical events have a significant impact on the price of gold as a safe-haven investment. In times of political unrest, wars, or other types of crises, investors move their funds to gold to protect their money. For instance the escalating tension in the Middle East, North Korea’s nuclear bombing, and uncertainty surrounding Brexit have all witnessed increases in the prices of gold. The fear and uncertainty associated with such events drive gold demand, further solidifying its position as a hedging asset.

Gold and Economic Data

As expected economic indicators and data releases also shape gold prices. GDP growth, jobs data, manufacturing activity or consumer confidence reports can affect investor sentiment and risk appetite. Positive economic data has a tendency to strengthen the dollar and equity markets, usually lowering gold prices. Poor economic data can surge gold demand as a safe-haven asset.

For instance poor job reports or slowing GDP growth can signal economic hardship to come, prompting investors to move out of riskier investments and into gold. Strong economic data on the other hand can lead to reduced gold demand as confidence in traditional investments like shares and bonds is increased.

Gold and Central Bank Policies

Major central banks like the FED (the Federal Reserve), the Bank of Japan or the European Central Bank, play a major role in deciding gold prices. Interest rate measures, quantitative easing, and foreign exchange reserve measures all have a direct impact on gold.

When central banks practice quantitative easing, increasing money supply and lowering interest rates, gold prices often rise. Quantitative easing is likely to bring inflation pressures and a weaker currency, both of which increase the demand for gold. When central banks tighten money policy, decreasing money supply and increasing interest rates, the price of gold falls as there are greater opportunity costs.

Central banks themselves are big buyers and holders of gold. Their purchases and sales have the potential to influence gold prices. For example, when emerging economies’ central banks increase their holding of gold, it has a tendency to increase prices by increasing demand.

Gold and Technological Advancements

Technological advances and innovations can also influence gold prices. Advances in mining and extraction technologies can shape supply conditions, while advances in financial technologies can impact the way gold is traded and invested in. Some examples include greater digital gold investment schemes as well as Gold IRAs that make it easier to invest in gold, leading to greater demand for gold.

Advances in technology in industries using gold, such as electronics and medicine, can affect industrial demand for the metal, leading to a pricier price of gold.

Gold’s price and its correlation with other economic and financial factors illustrate its unique position within the world economy. Its correlation with the dollar, interest rates, and equities works to define its position as a safe-haven financial instrument during times of economic stress. The positive correlation with inflation and the effect of geopolitical tensions work to further cement its role as a popular store of value.

Understanding these correlations will help you decide if it is advisable to invest in gold products within your retirement fund including your IRA account. Check for example my Noble Gold Investments review for more details!